Discover your home buying power with our Free Home Loan Eligibility Calculator based on Gross Salary. Find out how much you can afford and plan your dream home purchase today

Home Loan eligibility is dependent on factors such as your gross salary, monthly income, current age, credit score, fixed monthly financial obligations, credit history, retirement age etc. Get the peace of mind by knowing all the details about your loan using our All in 1 Home Loan Eligibility Calculator for Salaried on gross salary.

What is Home Loan Eligibility ?

Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a particular loan amount. Home loan eligibility depends on criteria such as age, financial position, credit history, credit score, other financial obligations etc.

How Much Loan Can I Avail ?

For e.g. If a person is 30 years old and has a gross monthly salary of Rs. 30,000 he can avail a loan of Rs. 20.49 lakh at an interest rate of 7.90% p.a. for a tenure of 30 years provided he has no other existing financial obligations such as a personal loan or car loan etc.

How is Home Loan Eligibility Calculated ?

Housing loan eligibility is primarily dependent on the income and repayment capacity of the individual(s). There are some other factors that determine the eligibility of home loans such as age, financial position, credit history, credit score, other financial obligations etc.

9 Must Read Home Loan Eligibility Criteria:

- Present Age and Remaining Working Years: The age of the applicant plays a major role in determining home loan eligibility. The maximum loan term is generally capped at 30 years.

- Age Limit for Salaried Individuals is 21 to 65 years.

- Age Limit for Self-Employed Individuals is 21 to 65 years.

- Minimum Salary: ₹10,000 p.m.

- Minimum business income: ₹2 lac p.a.

- Maximum Loan Term: 30 years.

- Financial Position: The present and the future income of applicant(s) has a significant impact on determining the loan amount.

- Past and Present Credit History and Credit Score: A clean repayment record is considered positive.

- Other Financial Obligations: Existing liabilities such as a car loan, credit card debt, etc.

7 Tips to Enhance Home Loan eligibility ?

- Adding an earning family member as co-applicant.

- Availing a structured repayment plan.

- Ensuring a steady income flow, regular savings and investments.

- Furnishing details of your regular additional income sources.

- Keeping a record of your variable salary components.

- Taking actions to rectify errors (if any) in your credit score.

- Repaying ongoing loans and short terms debts

How to use Home Loan Eligibility Calculator for Salaried ?

Our Home Loan Eligibility Calculator facilitates checking eligibility for housing loans online.

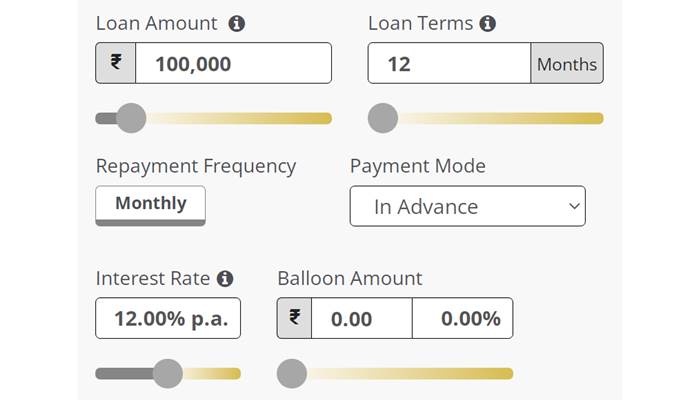

- Gross Income (Monthly) in ₹: Input gross monthly income. NRI should input net income.

- Loan Tenure (In Years): Input the desired loan term for which you wish to avail the loan. A longer tenure helps in enhancing the eligibility.

- Interest Rate (% p.a.): Input Bank prevailing housing loan interest rate. Click here to know the HDFC prevailing interest rates.

Apply for a Home Loan and Calculate Your Home Loan Eligibility

Once you get an indication of your eligibility and EMI amount by using our calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans.

Apply for a Home Loan and Calculate Your Home Loan Eligibility with Home Loan Eligibility Calculator on Gross Salary.

In case you would like us to get in touch with you, kindly leave your details with us. We also offers a facility of a pre-approved home loan even before you have identified your dream home.

This calculator is provided only as general self-help Planning Tools. Results depend on many factors, including the assumptions you provide. We do not guarantee their accuracy, or applicability to your circumstances.